“Hey! Is the stock market going up or down?”

This is the number one question I get asked every time I mention that I trade stocks and options on the stock market.

My answer is always the same. The market will go where ever the market feels like going, and It doesn’t really matter which direction it is going. All you have to do is know in the short term, what direction the market is going, and exploit the quick gains.

Besides that, it is illegal to have inside information and know exactly which direction the market is heading.

Learn about insider trading here: https://www.investopedia.com/terms/i/insidertrading.asp

Warren Buffet said that the market is a giant pile of money that is constantly getting shuffled around. This is the case for the stock market, people are always putting their money in, and taking their money out. This causes stock prices to fluctuate up and down.

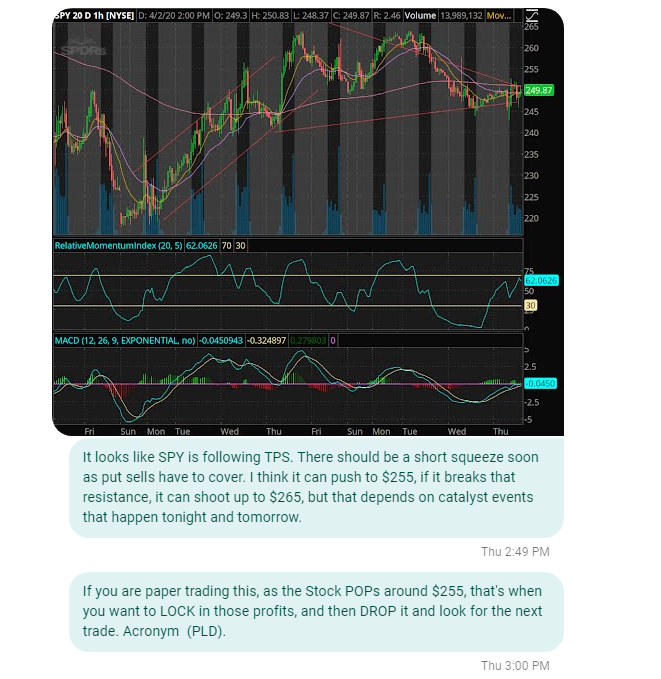

Today, I want to discuss the market as a whole for the past two weeks. The stock ticker SPY is a SPDR ETF which is composed of the top 500 companies listed on the stock market. This is also referred to as the S&P 500. There are other ETFS, but I want to focus on this one, because I use this one to get a feel for which direction I think the market is going next so that I can exploit some easy money and quick wins!

This chart was generated by thinkorswim for the SPY ticker from Friday 3/13/20 to Thursday 4/2/20.

I used 5 elements to identify and predict the next move for this stock.

- MACD

- RSI

- Gravitational Theory

- Trend Pattern Squeeze

- Support and Resistance

These elements are taught in my short video lectures for students of the January 2020 class. I also teach them on a daily basis as I enter and exit trades.

As soon as I saw these 5 elements, I alerted my students about the trade, and gave clear instructions on what to do. This is a preview of what the alert looked like.

Keep in mind, this is all on 4/2/20.

Look at what happened in the next few days.

The SPY followed the squeeze, rapidly exploded to $255 from $249 the very next trading day. The day after, it hit a high of $275! If you would have known that this was going to happen, you could have turned $400 into $2400 in 3 days by playing the call option on the 4/17 SPY $255 C.

Keep in mind, that is a 600% win per option contract. If you had $2000 or 5 contracts, this would have turned into $12,000 in 3 days!

Overall, I am very happy that some of my students were able to make use of the short squeeze and make some quick and easy money!

Happy Trading! I will try and regularly write reports similar to this so that we can have a journal of all our trades throughout the year.

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken