Ken Here.

We are officially on Day 22 of quarantine – the impacts of the pandemic hasn’t finished its course.

I know that a lot of you have given up hope, because you loss your job. Times are tough, and the struggle is real. There aren’t a lot of places hiring right now, and you still have to pay the bills, I understand this completely.

My solution is quite simple, trade and make money on the stock market!

There are 5 major reasons why I always recommend and teach trading:

- You do not have to create any content.

- You do not have to talk to any negative customers.

- Nobody can tell you to go home or take a break. You are your own boss.

- Nobody schedules your hours, you work when you want to and with whom you want to. (The only limit is the market hours: 8:30 AM CST to 4:00 PM CST.)

- The amount of pay you receive has NO LIMIT, you aren’t limited to a measly $500 a week paycheck.

Before we begin, these are 4 essential thoughts on my mental checklist:

- Do we have a plan? – Yes, I will lay out the plan on each of these trades.

- Why am I getting into this trade? – Each trade will be justified by my key elements.

- Do I have an exit strategy? – I will clearly define the exit strategy.

- Did I check the size of my position? – Do not enter a trade with more than you are willing to lose, this only creates financial stress and lack of sleep from worrying about your doubts.

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

Nothing is 100% guaranteed on the market, but these are my highest conviction trades for April 2020. I will write another report showing the results of how these trades pan out.

Don’t forget to ignore the trolls.

Most websites and forums post a bunch of lousy irrelevant crap with tons of technical analysis. I believe these posts are full of noise created by a bunch of trolls. If you have ever visited www.stocktwits.com or wallstreetbets you probably have seen them. If you have ever asked a professional trader what they think about these sites, I can guarantee they will all tell you the same thing. “I ignore what other people say, and I do my own due diligence based on my trading edges.”

The explanations of these trades are going to be as concise and crafted as simple as possible.

I will never write such an in-depth watchlist again, so pay close attention.

Traders pay over $10,000 a year for this type of knowledge.

These trades are all going to be swing trades, meaning you can take your profits anywhere from 1 day to 5 days. Take your winnings as soon as you feel comfortable doing so, I am going to define price targets, but you can always take the win a lot sooner.

These are trades which could be affected by Monday’s market volatility, so be cautious if the SPY opens low. Currently, the SPY is trending upwards, so always make sure the SPY isn’t crashing before entering trades.

Once again I believe these are good stocks to buy and trade.

Let’s dive right in.

Add these 5 stock tickers to your trading platform:

I am going to be trading these stocks starting Monday 4/13/20.

- STOR – STORE Capital Real Estate Investment Trust Company

- DAL – Delta Air Lines

- WORK – Slack Technologies Software Company

- WBA – Walgreens Boots Alliance Retail Pharmacy Company

- LYV – Live Nation Entertainment Company

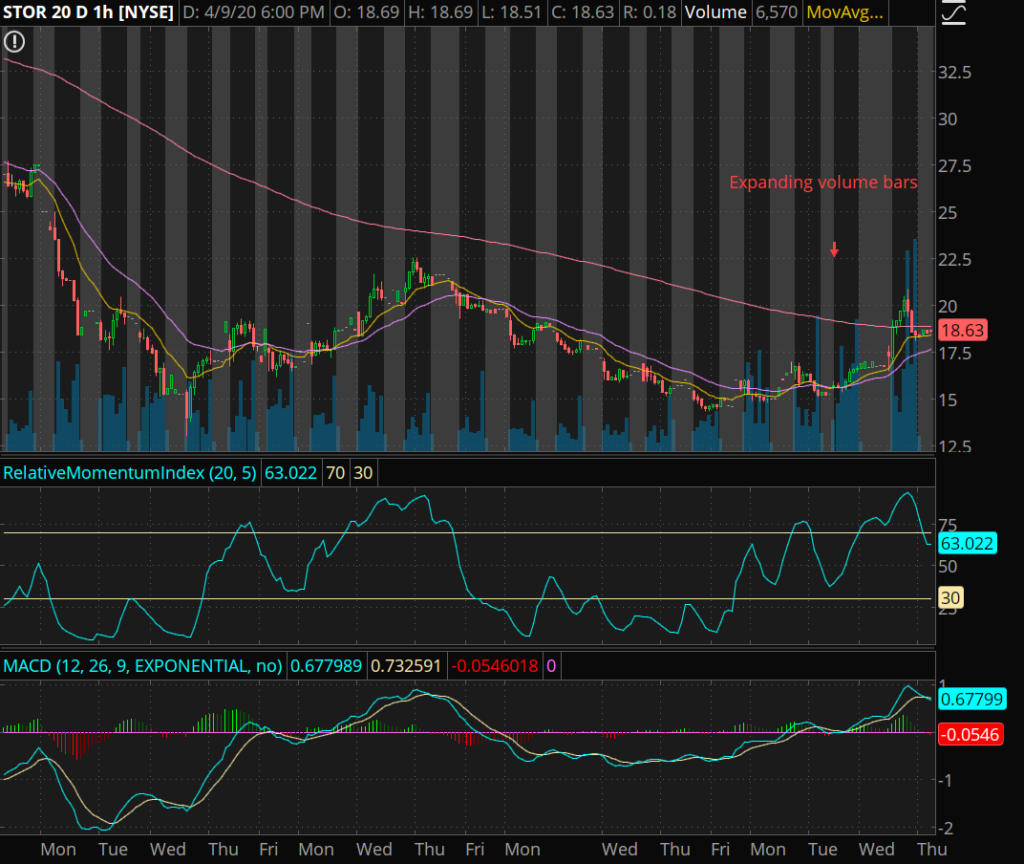

STOR

STOR use to be priced at $40 before the pandemic, it is currently trading at $18 (45% of its value).

The Dividend yield is sitting at 7.6% which is pretty high for an annual return (This is attractive for long term investors).

The last traded closing volume was 14 million shares. Multiply this by the share price and you will notice there is tons of money flowing in and out on this stock.

Look at the chart.

I used 5 elements here:

- Gravitational theory – The stock price is getting pulled towards that pink line.

- Expanding volume bars – Indicates more and more people are buying the stock.

- Support and Resistance – The stock has a support level of $15, and a Resistance level of $20.

- RSI

- MACD

You have two options here. Buy the stock or buy the option.

Stocks: You own a share which has no expiration date, theoretically it can drop, but it most likely will never go to $0 before you have a chance to sell it.

Options: You own the right to purchase 100 shares per option, but do not own a share. If it expires out-of-the-money it will be worth $0.

Stock: I would purchase this stock around $18.80 to $19.20. I would sell the stock as soon as it reaches $20.50 to $21. This would yield a $2 a share profit.

Options: I would go with a $20 Call with the expiration date of 4/17 for around $0.45 ($45 each) if you want to have a high risk high reward trade. If you want to be safer, purchase the 5/15 $20 Call for around $1.35 ($135 each). I would sell these options as the stock price reaches $20.50 to $21. This would yield about a 100% profit, or doubling your money.

You can use this Options Profit Calculator to see an estimate of how much money you can make per successful trade.

Let’s provide a scenario: I buy one $20 Call contract for $135 with a 5/15 expiration. When the price hits $21, I can turn around and sell that call for $272. This will yield a profit of $137.

The stock option is safer, but the yield is significantly less. I am an options trader, so I am going to trade the option.

Stop loss price: If the stock price is about to close near $17, I will sell my options at a loss to prevent further losses.

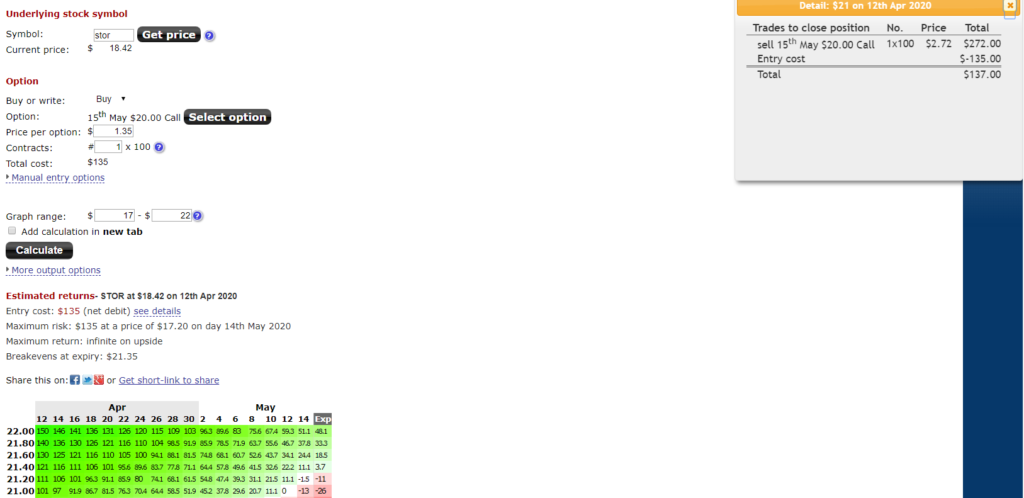

DAL

DAL use to be priced at $63 before the pandemic. It is now at $24 (38% of its value).

The dividend is at 6.6% which is attractive to long term investors.

The last traded volume was 91 million shares.

Look at the chart.

I used 5 elements here:

- Gravitational theory – The stock price is getting pulled towards that pink line.

- Expanding volume bars – Indicates more and more people are buying the stock.

- Support and Resistance – The stock has a support level of $20, and a Resistance level of $32.

- RSI

- MACD

Again, you have two types of trades here. Buy the stock, or buy the option.

Stock: I would purchase this stock anywhere from $25.40 to $26. I would sell it as it approaches $28 to $29.

Option: I would purchase the $28 Call with the expiration date of 5/1 around $1.30 ($130 each). I would sell the options as the stock price reaches $28 to $29.

This trade has the potential to have a 300% return or 3x your money.

Stop loss price: If the stock price is about to close near $24, I will sell my options at a loss to prevent further losses.

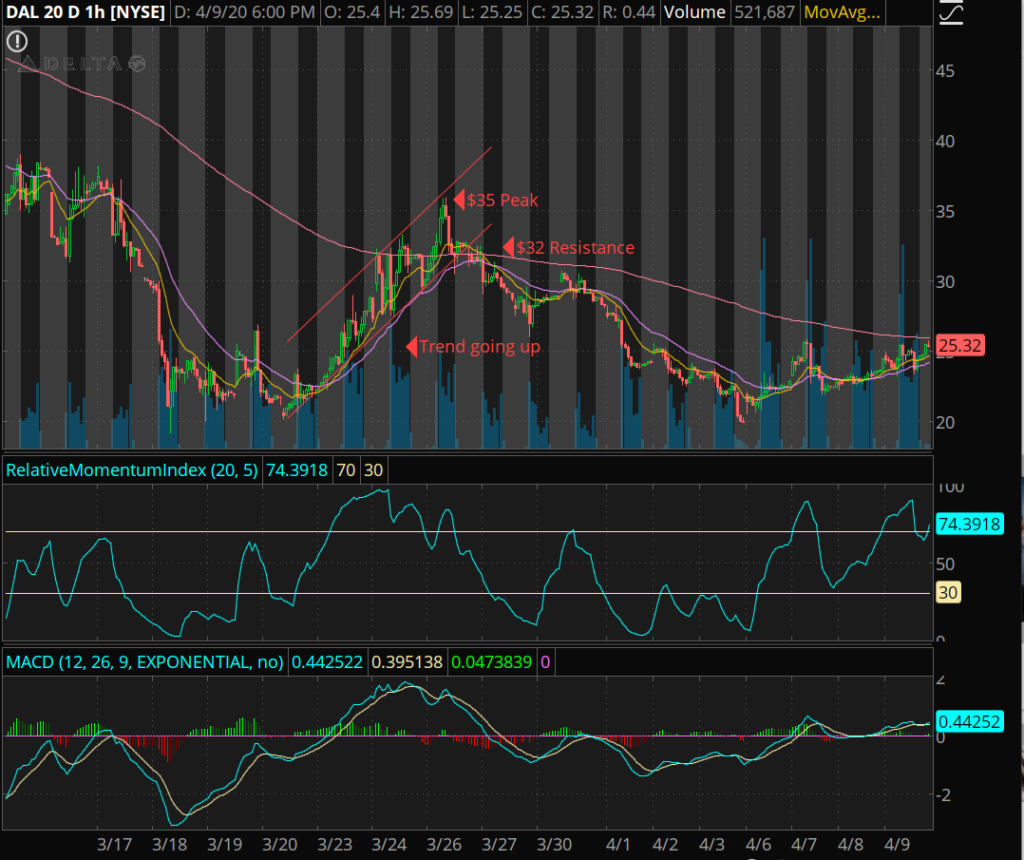

WORK

WORK recently had its IPO this year. So it doesn’t have a defined high. However, it is making a significant impact for companies that require their employees to work from home due to social distancing.

The last traded volume was 10 million shares.

Look at the chart.

I used 5 elements here:

- Gravitational theory – The stock price is getting pulled towards that pink line.

- Trend Pattern Squeeze – The stock is trending up, there is a consolidation. The next phase is a squeeze past the gravitational line.

- Support and Resistance – The stock has a support level of $24, and a Resistance level of $29.

- RSI

- MACD

Stock or the option?

Stock: I would purchase this around $24.80 to $24.90, and sell it as the price goes towards $26.

Option: I would purchase the $26 Call with the expiration date of 4/24 around $0.80 ($80 each). I would sell the options when the stock price hits $26.

This will yield about a 200% return or double your money!

Stop loss price: If the stock price is about to close near $23, I will sell my options at a loss to prevent further losses.

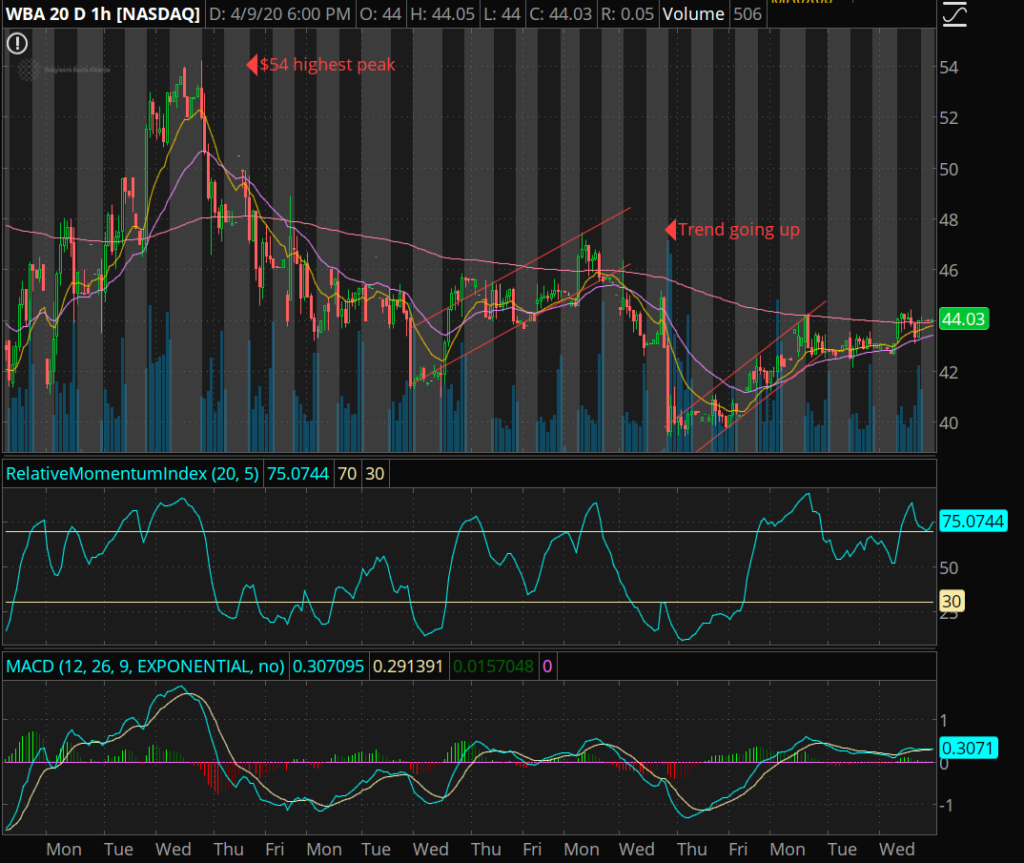

WBA

WBA use to be priced at $62 before the pandemic. It is trading at $44 (70% of its value).

The dividend is 4.16% which isn’t super high, but the stock is relatively stable compared to the market. This is what conservative investors typically buy, and there are lot of those type of people.

The last trading day had 7 million shares traded.

Look at the chart.

I used 5 elements here:

- Gravitational theory – The stock price is getting pulled towards that pink line.

- Trend Pattern Squeeze – The stock is trending up, there is a consolidation. The next phase is a squeeze past the gravitational line.

- Support and Resistance – The stock has a support level of $42, and a Resistance level of $44.

- RSI

- MACD

Stock: I would purchase this stock between $44 and $44.20 and sell it as the stock goes to $46.50

Option: I would purchase the $45 Call with the expiration date of 4/24 around $1.25 ($125 each) and sell the options around $46.60.

This will yield about a 50% return or 1.5x your money. It is a more conservative stock, so the volatility is lower, but so is the risk.

Stop loss price: If the stock price is about to close near $42, I will sell my options at a loss to prevent further losses.

LYV

LYV use to be priced at $71 before the pandemic. It is now at $38 (53% of its value).

The last trading day had 6 million shares traded.

Look at the chart.

I used 5 elements here:

- Gravitational theory – The stock price is getting pulled towards that pink line.

- Trend Pattern Squeeze – The stock is trending up, there is a consolidation. The next phase is a squeeze past the gravitational line.

- Support and Resistance – The stock has a support level of $38, and a Resistance level of $45.

- RSI

- MACD

Stock: I would purchase this stock between $38.40 and $38.80 and sell it as the stock goes to $42.

Option: I would purchase the $42.50 Call with the expiration date of 5/15 around $2.25 ($225 each) and sell the options around $43.

This is a longer swing trade, but it has the potential to make a 200% return, or a double your money trade.

Stop loss price: If the stock price is about to close near $37.50, I will sell my options at a loss to prevent further losses.

Stay tuned, learn more, ask questions. Become a 6 digit survivor. Check out the live stream.

Join my robinhood team and get a free stock here

Learn about my Indicators here.

Become a member and learn!

Disclaimer:

I want to point out, I am not a registered investment adviser or broker/dealer. I am a highly profitable options trader who has been successful time after time, and I have changed the lives of many people through the art of trading on the stock market.

– Ken